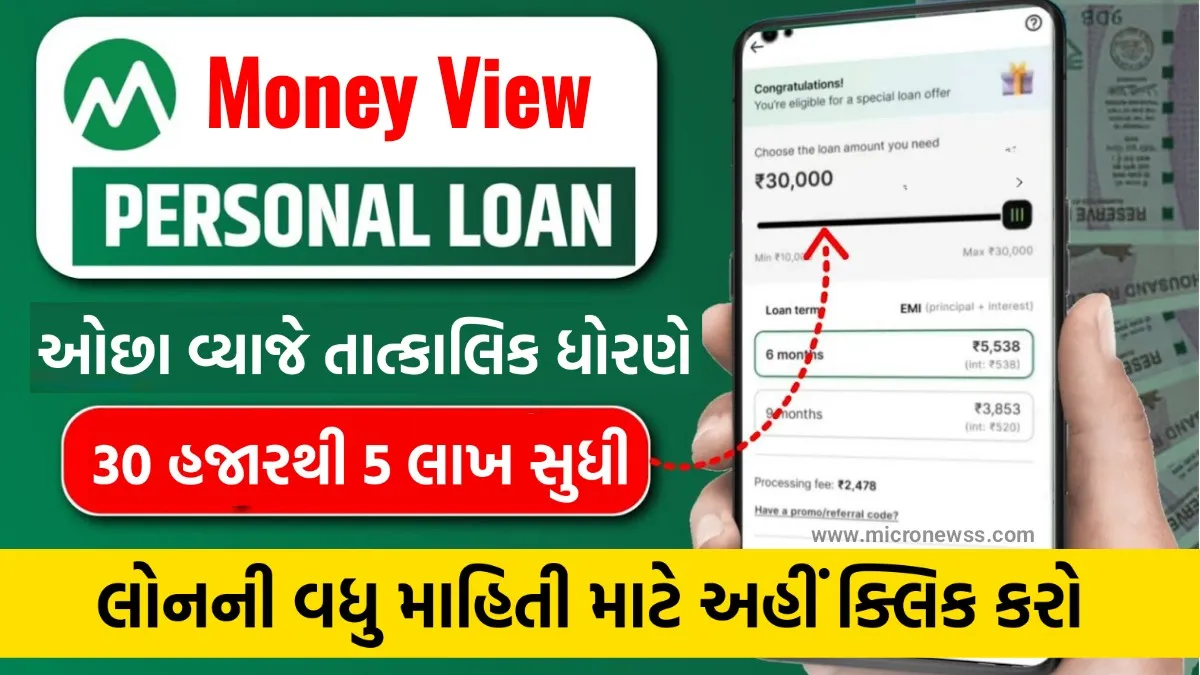

How To Take Loan From Money View? Money View Instant Short Term Loan is one of the most convenient options for customers for instant personal loans. Customers can avail easy and hassle free loan in as little as 24 hours of application. The loan amount can be up to a maximum of Rs 5,00,000 for an interest rate as low as 1.33% per month. The maximum tenure of these instant loans is 5 years and the processing fee is a minimum of 2% of the loan amount. Quickly check Money View Instant Short Term Loan eligibility in under 2 minutes.

Money View Se Loan Kaise Le – How to take loan from Money View?

Personal loan is one of the easiest loan options available to customers in the market. The purpose of the loan can be quite flexible. Also, the documents and eligibility for personal loan are not as strict as compared to business loan or housing loan etc. Institutions.

Money View is one of the popular NBFCs for customers to avail instant personal loans. Loan disbursement under Money View can be as fast as within 24 hours of application. Here are the details of Money View’s instant short term loans.

Eligibility for Money View Loan

Money View offers instant personal loans up to Rs 5,00,000 to salaried as well as self-employed individuals. For this purpose, it has set specific eligibility criteria for eligible applicants with respect to age, income limit and credit score. Are.

Looking for the best personal loan in the market? Money View Personal Loan comes with a range of benefits. All you have to do is fulfill their eligibility criteria.

How is eligibility calculated for taking a loan from Money View?

Personal loan eligibility is calculated based on the borrower’s credit score, income and age among other factors.

To avail an instant personal loan from Money View, one must fulfill the following eligibility criteria –

- Types of Employment:You must be salaried or self-employed

- monthly income:Your monthly in-hand income should be Rs 13,500/- or more.

- Income in Bank:Your salary should be deposited directly into your bank account

- Credit Point:You must have either a minimum CIBIL score of 600 or a minimum experience score of 650.

- Age:Applicants age should be between 21 years to 57 years

Personal Loan Eligibility Criteria based on applicant’s place of residence

Income and credit score requirements will vary depending on the applicant’s city of residence as shown in the table below –

Income and Credit Score Eligibility Criteria

| City | Income | credit score |

| Any city or town across the country | Rupee. 20,000 | Between 1-299 or for those new to credit |

| Mumbai/Thane or NCR region (Delhi, Noida, Gurgaon, Ghaziabad, Faridabad, etc.) | Rupee. 20,000 | Minimum Credit Score 650/750 as applicable |

| Other metro cities (except Mumbai and NCR) | Rupee. 15,000 | Minimum credit score of 675 |

| Any city other than the above mentioned cities | Rupee. 13,500 | Minimum Credit Score 650/750 as applicable |

Factors that affect personal loan eligibility

Below are some factors that affect your personal loan eligibility –

1. Credit Score

If your credit score is high (>700), you are considered less risky in case of default in your repayments and hence can avail higher loan amounts at lower interest rates.

2. Types of Employment:

The lower the risk associated with repayment, the lower the interest rate. This is why salaried applicants usually get loans at lower interest rates because this type of employment carries less risk than the self-employed.

3. Income Level:

The higher the income, the higher the repayment capacity unless more than one loan is active at the same time, that is, as long as your debt-to-income ratio is low. In Money View, applicants must have a minimum monthly income of Rs 13,500 for salaried people and Rs 15,000 or more for self-employed people.

4. Age:

Another factor that determines eligibility is your age. Generally, currently earning people can easily get loans, while those nearing retirement will not be able to do so and even if they do, it will be at higher interest rates. At Money View, you must be between 21 to 57 years of age to avail a personal loan.

5. Area of residence:

Those living in Tier-I cities generally require higher income and credit scores than those living in Tier-II and Tier-III cities.

Expenses may be higher than income, making repayments a little riskier.

Tips for salaried individual to check eligibility

- 13,500 as your monthly income

- Your income should be deposited directly into your bank account

Apart from your income, the amount you receive as a loan, the interest charged, and the repayment period can be

The Money View Personal Loan EMI Calculator can help you find out how much you owe and knowing this will help you plan your expenses if you qualify for the loan amount of your choice.

Money View Loan Interest Rates and Charges

The interest rates and other charges for personal loans at Money View are transparent and affordable with no hidden costs.

| Fees and Charges | Amount |

| Rate of interest | Starting at 1.33% per month |

| Loan Processing Fee | Starts from 2% of the sanctioned loan amount |

| Interest on overdue EMI | 2% per month on overdue EMI/original loan amount |

| check bounce | Rs 500/- every time |

| loan cancellation | No additional charges are imposed |

| The interest amount will be payable for the period between loan disbursement and loan cancellation. | |

| Processing fees will also remain intact |

Documents required for Money View Loan

Are you looking for a personal loan with minimum document requirements? Then you have come to the right place.

To avail a personal loan from Money View you need to submit the following documents –

Your PAN card, in most cases, will be sufficient for us to determine your eligibility. However, in some cases we will require additional documents for proof of address and income.

Acceptable documents for proof of ID, address and income are given below –

PAN Card – This is the primary identity proof required. However, if it is rejected due to image quality issues or other reasons, any 1 of the official valid documents given below will suffice

- Aadhar card

- valid indian passport

- Valid Voter ID Card

- valid driving license

- Utility bill (electricity, water, gas) dated within the last 60 days

Salaried Applicants – Last 3 months bank statement of your salary account in PDF format showing salary credit

come on

Self-Employed Applicants – Last 3 months bank statement in PDF format

1. List of documents required for salaried employees

If you are a salaried employee and you meet the eligibility criteria, you will be required to provide the following documents –

However, if this document is unacceptable due to such image quality issues, then any of the following documents will be accepted –

Any 1 of the following (Proof of Identity)

- valid indian passport

- Aadhar card

- valid driving license

- Valid Voter ID Card

Any 1 of the following (Proof of Address)

- Aadhar card

- Valid Voter ID Card

- valid indian passport

- Utility bill (electricity, water, gas) dated within the last 60 days

- valid driving license

Amount of income

Last 3 months bank statement of your salary account showing salary credit in PDF format

2. List of documents required for self-employed employees

All self-employed applicants must submit the following documents –

The most important document that will be required is your PAN card.

If the application is rejected for any reason, any of the following documents will be accepted –

Any 1 of the following (Proof of Identity)

- valid indian passport

- Valid Voter ID Card

- valid driving license

- Aadhar card

Any 1 of the following (Proof of Address)

- valid indian passport

- Valid Voter ID Card

- valid driving license

- Aadhar card

- Utility bill (electricity, water, gas) dated within the last 60 days

Amount of income

Last 3 months bank statement in PDF format.

3. List of documents required for pensioners

If you are a pensioner requiring a loan from Money View, assuming you meet the eligibility criteria of Money View, you will need to provide the following documents –

The most important document that will be required is your PAN card. However, if for any reason this document is not accepted, any of the following documents will be accepted –

Any 1 of the following (Proof of Identity)

- valid driving license

- valid indian passport

- Aadhar card

- Valid Voter ID Card

Any 1 of the following (Proof of Address)

- Aadhar card

- Utility bill (electricity, water, gas) dated within the last 60 days

- Valid Voter ID Card

- valid driving license

- valid indian passport

Amount of income

Bank statement of last 3 months in PDF format, showing your deposited pension