It’s feeling pretty sparklling but the future of AI is going to be very big.

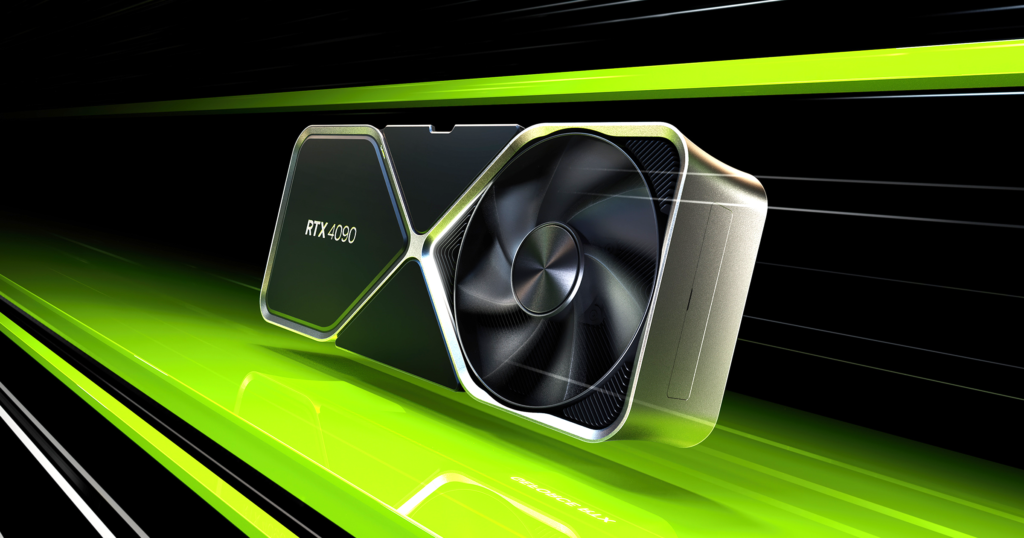

Nvidia stock :“Nvidia’s Meteoric Rise: Evaluating the Stock’s Trajectory Amidst the AI Boom”

Summary

- Nvidia Corporation has experienced a remarkable surge, surpassing previous peak levels from November 2021, primarily due to its impressive performance in Q1 FY2024. The company achieved double beats in its financial results, exceeding expectations, and its management provided exceptionally positive guidance for the future. This has propelled the stock to new heights and solidified its chart-topping trajectory.

- The demand for AI chips has reached an unprecedented level, creating a frenzy that is significantly driving Nvidia Corporation’s projected Q2 FY2024 revenue. The company anticipates a staggering 54% quarter-on-quarter growth and an impressive 64% year-on-year growth, marking a return to its previous high-growth trajectory. This surge in demand underscores the continued importance and prominence of Nvidia’s AI chip offerings.

- Despite the current optimism surrounding Nvidia’s valuations and stock prices, it is crucial to remember the painful lessons from the tech bubble burst in 2022. The market’s enthusiasm may have overshadowed the risks associated with inflated valuations and speculative investing. It serves as a reminder that caution should be exercised, considering the potential volatility and uncertainties in the tech sector.

- At present, it appears that a combination of peak irrationality, concerns about a potential economic downturn, and the hype surrounding generative AI may have artificially inflated Nvidia Corporation’s prospects in the medium term. These factors have contributed to an atmosphere of heightened expectations and speculative enthusiasm. It is important to carefully assess the sustainability and underlying fundamentals driving Nvidia’s growth during this period of potentially exaggerated optimism.

Nvidia (NVDA -1.11%) stock has been experiencing significant growth, driven by the excitement surrounding AI technology and the anticipation of high chip sales fueling the AI revolution. Nvidia stock The question is whether the stock is still on an upward trajectory or if it has already reached its peak and is poised for a decline. In a video, Motley Fool contributors Jason Hall and Jeff Santoro present two reasons why waiting for a price dip could be a wise strategy, along with one reason why purchasing shares now might be favorable.

Is it right time invest $1,000 in Nvidia right now ?

Nvidia stock :The analyst team at The Motley Fool Stock Advisor recently unveiled their selection of what they consider to be the top 10 stocks for investors to purchase at this time. Surprisingly, Nvidia did not make the list. Nvidia stock : Stock Advisor is an online investment service renowned for outperforming the stock market by threefold since 2002*. Currently, their experts believe that there are 10 other stocks that present more promising buying opportunities.

5 stock under $49

Nvidia stock : Investors often express their regret about not purchasing stocks like Amazon or Netflix when they were initially recommended by The Motley Fool. The incredible growth these stocks have experienced is undeniable. In light of the recent market decline, it's crucial to remember the importance of being a long-term investor. If you had invested in Amazon when we issued a "buy alert" at $15.31 per share, your investment would have soared by 16,131%. Similarly, investing in Tesla at $6.37 per share, as we recommended, would have yielded a remarkable 9,980% gain. While Amazon and Tesla have performed exceptionally well, we believe that five other stocks present compelling buying opportunities. The best part is, you can purchase these stocks now for less than $49 per share. For a limited time, you can obtain a complimentary copy of "5 Stocks Under $49" to explore these enticing investment options. Avoid the future regret of inaction by entering your email below to gain immediate access to our five free stock picks.

Time to invest in AI ?

Nvidia stock : The current market sentiment and investor behavior towards NVIDIA Corporation (NASDAQ:NVDA) have shown signs of irrationality, leading to the stock reaching its all-time high of $401.11 at the time of writing. One of the driving factors behind this rally is the hype surrounding artificial intelligence (AI), particularly since the launch of ChatGPT in November 2022. This has further fueled investor excitement, along with the company's exceptional performance in FQ1'24, surpassing expectations, and providing strong forward guidance for FQ2'24. NVIDIA has projected a remarkable revenue of $11 billion for the next quarter, representing a significant increase of 52.9% quarter-on-quarter and 64.1% year-on-year, surpassing consensus estimates by 54.7%. Additionally, the company has seen an expansion in GAAP gross margins to 68.6%, a 4-point increase quarter-on-quarter and a substantial 25.1% increase year-on-year. The GAAP operating income is estimated to be approximately $4.83 billion, exhibiting an impressive 125.7% quarter-on-quarter growth and an astounding 867.9% year-on-year growth. These numbers certainly deserve recognition, evident in the significant surge in the stock's price. According to CEO Jensen Huang's commentary, it appears that the era of central processing units (CPUs) might be coming to an end, as the growing demand for generative AI and computing capacity is driving the redesign of data centers towards graphics processing units (GPUs). The combination of strong financial performance, positive forward guidance, and the potential transformation of data centers has propelled NVIDIA's stock to unprecedented heights.

Nvidia head & shoulder Pattern in 2021/2022

While the current situation for NVIDIA Corporation (NVDA) seems promising, caution is warranted. The pattern of rapid growth followed by a subsequent decline is reminiscent of NVDA's previous head and shoulder pattern in November 2021. This raises concerns about the sustainability of the current jump in demand and whether it can support the stock's new heights during a potential recession. Additionally, with the stock potentially bordering on overvaluation, there may be limited margin of safety in adding to positions at this point. However, it's worth noting that part of the enthusiasm may be attributed to the recovery in NVDA's other segments. The Gaming segment recorded $2.24 billion in revenue, representing a 22% increase quarter-on-quarter but a 38% decrease year-on-year. The Professional Visualization segment reached $295 million in revenue, showing a 31% increase quarter-on-quarter but a 53% decrease year-on-year. The Automotive segment reported $296 million in revenue, reflecting a 1% increase quarter-on-quarter and an impressive 114% increase year-on-year. Notably, NVDA has secured a design win pipeline of $14 billion through 2029, with partnerships such as BYD Company Limited, the world's largest electric vehicle maker by volume, adopting NVIDIA Drive Orin across its next-generation series. This partnership with BYD could potentially drive a strong tailwind in the automotive sector. NVDA's AI strategy is also promising, with its data center revenue reaching $4.28 billion, an 18.2% increase quarter-on-quarter and a 14.1% increase year-on-year. The growing demand for generative AI is driving this growth, and the management aims to increase supply significantly to meet the surging demand for its data center products. Furthermore, NVDA appears to be outperforming competitors in the data center market, with Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC) reporting underwhelming performances in this segment. Considering these factors, it is plausible to surmise that NVDA may continue to grow its market share in the discrete GPU market and solidify its dominance in the semiconductor industry. This reinforces its position as a leader in the next semiconductor supercycle, given its impressive performance and brand recognition in the industry. However, despite the positive outlook, it is important to approach the situation with caution, considering the potential risks and uncertainties associated with market dynamics and valuation levels.

Nvidia stock Nvidia stock Nvidia stock Nvidia stock

Our social media accounts : https://www.facebook.com/profile.php?id=100091399643379 our web home page : https://micronewss.com/