Today Stock market News

S&P Live today growth :

S&P Rises The S&P 500 index soared to a fresh nine-month high, propelled by the standout performance of technology giant Apple. This impressive feat highlights the dominant role played by Apple in driving the market's upward trajectory. The index experienced a significant boost, recording substantial gains and signaling an optimistic sentiment among investors.

Apple is a key player of technology

Apple, a key player in the technology sector, led the charge with a remarkable surge in its stock price. The company's shares skyrocketed, reaching unprecedented heights and contributing significantly to the S&P 500's upward movement. Apple's strong performance reflects the market's confidence in the company and its ability to deliver innovative and sought-after products.

S&P Rises The rise in the S&P 500 underscores the resilience and strength of the overall market, as it reached its highest level in nine months. This achievement signifies a period of sustained growth and investor confidence, with Apple leading the charge and setting the tone for other companies in the index.

Live Update on Today S&P :

S&P Rises :The S&P 500, a widely followed benchmark index, reached a significant milestone on Monday as it surged to its highest level in nine months. The rise was primarily driven by the impressive performance of technology giants such as Apple. The index saw a gain of 0.3%, while the Nasdaq Composite, which is heavily weighted towards technology stocks, experienced a more substantial jump of 0.6%. In contrast, the Dow Jones Industrial Average dipped slightly by 50 points, or about 0.2%. Apple, one of the key contributors to the market's upward movement, witnessed a remarkable increase of over 2% and reached an all-time high. This surge in value occurred just before the highly anticipated unveiling of Apple's virtual reality headset at the company's annual Worldwide Developers Conference. Other technology stocks also enjoyed gains, with Alphabet and Oracle each seeing a rise of over 1%. Additionally, Netflix experienced a notable increase of 2.4%. However, the financial and banking sectors faced challenges during this period. News of regulators considering raising capital requirements at large banks caused some financial stocks to decline. Names such as JPMorgan and Goldman Sachs, along with Intel and 3M, exerted downward pressure on the Dow. The recent stock market rally followed a strong performance, with the May jobs report providing optimism to investors. This report suggested that the long-anticipated recession may not materialize until 2024 or may not occur at all. Furthermore, the passage of the debt ceiling bill further bolstered investor sentiment. Despite these positive developments, uncertainties linger. Market participants remain concerned about the narrow nature of the stock market rally in 2023, which has been led primarily by a small number of tech stocks. There are apprehensions regarding the possibility of an intermediate-term correction if broader market participation does not improve. Chris Zaccarelli, the chief investment officer at Independent Advisor Alliance, believes that if the economy continues its steady progress without showing any signs of a recession, other sectors of the market will have an opportunity to catch up, potentially closing the performance gap with the tech sector. Mohamed El-Erian, the chief economic advisor at Allianz, highlighted the importance of the Federal Reserve's actions in the market's future trajectory. He emphasized that while concerns surrounding significant debt and banking issues have diminished, the central bank's approach to tackling inflation will play a crucial role. El-Erian suggested that if the Federal Reserve adjusts its target from the current 2%, which he deems inappropriate, the markets could reach a fair valuation. Overall, the current market environment is a mix of positive momentum driven by tech stocks, concerns over sector concentration, and uncertainties related to the Federal Reserve's actions and inflation management. Market participants are closely monitoring these factors to gauge the potential direction of the broader market.

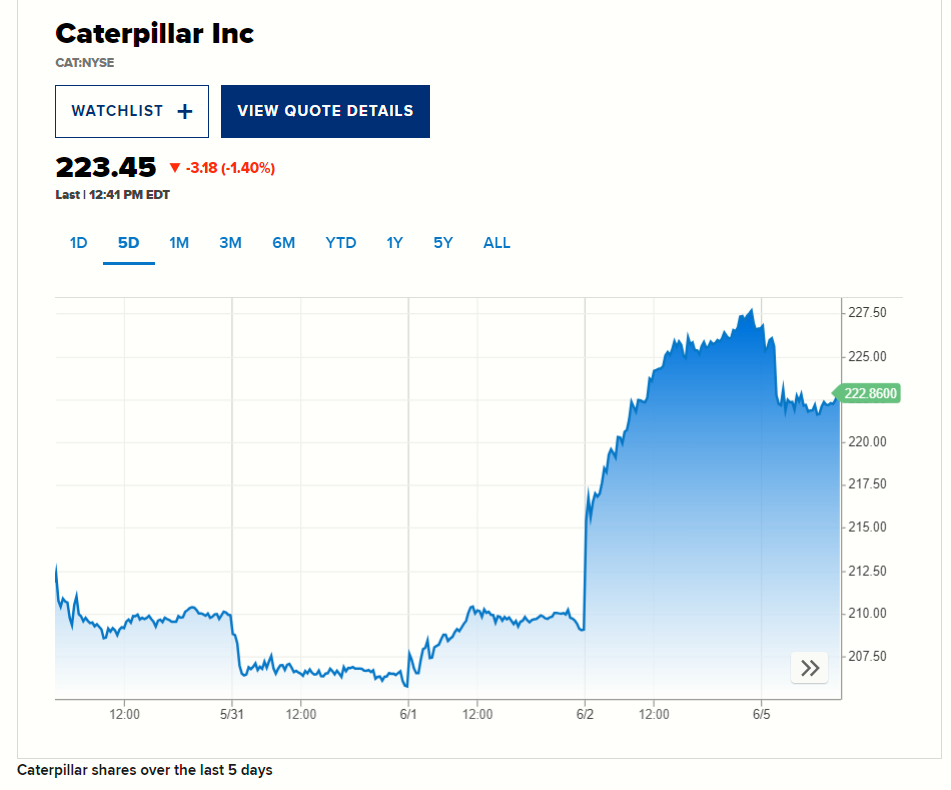

Caterpillar recoil after posting best day since March 2020

Caterpillar's stock price experienced a decline of nearly 2% on Monday, following a significant increase on the previous day. On Friday, the construction manufacturer saw a remarkable surge of 8.4%, marking its largest one-day gain since March 24, 2020, when the stock rose by 10.3%. However, on Monday, Caterpillar's retreat caused it to become the third-worst performer among the 30 stocks listed in the Dow Jones Industrial Average. The Dow Jones as a whole experienced a relatively minor decline of 0.2% during the session. In comparison, both Intel and 3M saw greater losses, slipping by 2.7% each. Apart from Caterpillar, banking stocks such as JPMorgan and Goldman Sachs also faced challenges during this period.

Apple and Oracle hit all-time highs

Apple and Oracle reached all-time high stock prices, surpassing the previous records set during their initial public offerings (IPOs) in 1980 and 1986, respectively. S&P Rises This signifies a significant milestone for both companies, as their stock prices have never been higher since they first entered the market. On the other hand, Epam Systems experienced a notable decline in its stock price, reaching lows that had not been seen since March 2022. This indicates a challenging period for the company, as its stock value has dropped to levels not witnessed in over a year. Similarly, Amcor saw its stock price drop to its lowest level since June 2020. S&P Rises This suggests a significant decline in investor confidence in the company, as its stock value has fallen to a point not seen in almost three years.

S&P Rises S&P Rises S&P Rises S&P Rises S&P Rises S&P Rises S&P Rises S&P Rises S&P Rises S&P Rises S&P Rises

OUR Social media sites https://www.facebook.com/profile.php?id=100091399643379 our home page :https://micronewss.com/