Warren Buffett Dividend Stocks

Introduction

Warren Buffett, widely regarded as one of the greatest investors of all time, has amassed a considerable fortune through his disciplined investment approach. One of the key strategies Buffett employs is investing in dividend stocks. Dividend stocks offer investors a unique opportunity to generate passive income while benefiting from potential capital appreciation. In this article, we'll delve into the concept of Warren Buffett dividend stocks, explore their advantages, and identify some of the top dividend stocks favored by the Oracle of Omaha.

The Importance of Dividend Stocks

Dividend stocks play a significant role in a long-term investment strategy, providing investors with a consistent stream of income. Unlike non-dividend stocks, which rely solely on capital appreciation for returns, dividend stocks offer a reliable income stream regardless of market conditions. This regular income can be reinvested or used to cover living expenses, making dividend stocks an attractive choice for income-oriented investors.

Warren Buffett’s Approach to Dividend Stocks

Warren Buffett has consistently emphasized the importance of investing in companies with strong competitive advantages and sustainable business models. When it comes to dividend stocks, Buffett focuses on companies with a track record of consistent dividend payments and a history of increasing dividends over time. He seeks businesses that generate robust cash flows and possess a durable competitive edge, enabling them to maintain and grow their dividends even during challenging economic periods.

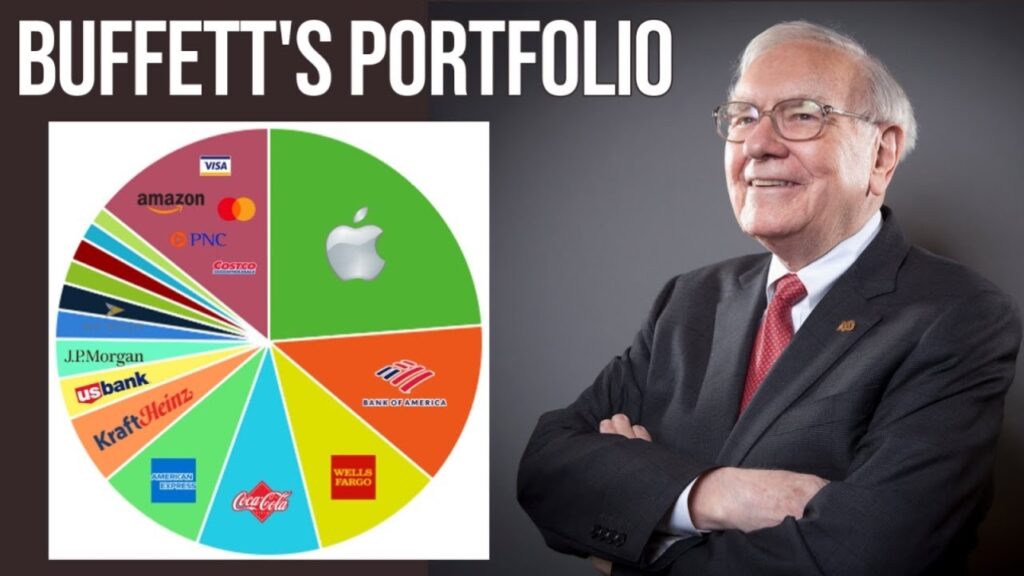

Top Dividend Stocks Preferred by Warren Buffett

Coca-Cola (KO): Coca-Cola has been a long-standing favorite of Warren Buffett, known for its global brand recognition and a history of increasing dividends for over five decades. The company's strong market position, resilient business model, and consistent cash flows make it an attractive choice for investors seeking dividend income.

Apple (AAPL): Despite not traditionally being considered a dividend stock, Apple made its way into Buffett's portfolio due to its strong financial position and robust cash flows. The tech giant initiated a dividend in 2012 and has consistently increased it since then. With a loyal customer base and a diverse product ecosystem, Apple remains an appealing dividend stock for long-term investors.

Bank of America (BAC): Buffett's significant investment in Bank of America demonstrates his confidence in the banking sector. Bank of America has made considerable progress in improving its balance sheet and profitability since the financial crisis. The bank's commitment to increasing its dividend, coupled with its dominant market position, positions it favorably as a dividend stock.

johnson & Johnson (JNJ): Johnson & Johnson is renowned for its global presence in the healthcare sector and its commitment to innovation. The company's diversified product portfolio, strong cash flows, and consistent dividend growth make it an attractive long-term investment option.

Incorporating Warren Buffett Dividend Stocks into Your Portfolio

When considering Warren Buffett dividend stocks for your investment portfolio, it is crucial to conduct thorough research and understand the underlying principles that guide Buffett's investment philosophy. Here are some key steps to help you incorporate these stocks into your portfolio effectively:

1 . Identify companies with competitive advantages: Buffett looks for companies with durable competitive advantages, often referred to as economic moats. These advantages could include strong brands, patents, or high barriers to entry. Seek out businesses with a sustainable competitive edge to ensure their long-term success.

2.Analyze historical dividend growth: Look for companies with a history of consistent dividend payments and a track record of increasing dividends over time. This demonstrates the company's commitment to rewarding shareholders and its ability to generate reliable cash flows. Aim for stocks with a steady dividend growth rate.

3.Assess financial health: Evaluate the financial health of the companies you are considering. Examine their balance sheets, cash flows, and profitability metrics. A healthy financial position indicates the company's ability to sustain and grow dividen

4.Diversify your portfolio: While dividend stocks can provide stability and income, it's essential to diversify your portfolio across different sectors and industries. This diversification helps mitigate risks associated with specific companies or sectors and ensures a well-rounded investment strategy.

5.Long-term mindset: Buffett's investment approach is focused on the long-term. When investing in dividend stocks, it's important to adopt a similar mindset. Dividend stocks are most effective when held for extended periods, allowing for the power of compounding to work its magic. Avoid getting swayed by short-term market fluctuations and focus on the long-term potential of the companies you invest in.

6.Monitor and review your investments: Regularly review the performance of your dividend stocks and keep an eye on any changes in the underlying fundamentals of the companies. Stay updated on financial news and market trends to make informed decisions about your portfolio.

Conclusion

Warren Buffett dividend stocks provide investors with a compelling investment opportunity for long-term growth and income generation. By following Buffett's principles of investing in companies with competitive advantages, consistent dividend growth, and strong financial health, you can build a portfolio that aligns with his successful investment strategy. Remember to diversify your holdings and maintain a long-term perspective to fully capitalize on the potential of dividend stocks. With careful research and disciplined investing, you can incorporate Warren Buffett dividend stocks into your portfolio, aiming for sustained growth and financial success.

Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks Warren Buffett Dividend Stocks

OURFACEBOOK GROUP :fACEBOOK GROUP OUR PAGE : fACEBOOK PAGE OUR WEBPAGE : HOME PAGE