Why to Buy AI Stocks ?

Different fields of AI :

Artificial intelligence Stock :Artificial Intelligence (AI) has revolutionized numerous industries, offering innovative solutions and transforming the way we live and work. This report explores the unique and groundbreaking applications of AI across various domains, showcasing its potential to drive significant advancements and create a positive impact on society.

1 . AI in Healthcare:

AI has emerged as a game-changer in the healthcare industry, with unique applications that are revolutionizing patient care. From early disease detection to personalized medicine, AI algorithms are enabling faster and more accurate diagnosis, improving treatment outcomes, and reducing medical errors. Additionally, AI-powered robotic assistance is transforming surgical procedures, making them safer and more precise.

2 .AI in Transportation:

The transportation sector is undergoing a transformation with the integration of AI technologies. Unique applications such as autonomous vehicles and traffic management systems powered by AI algorithms are enhancing safety, optimizing traffic flow, and reducing congestion. AI is also being utilized in logistics and supply chain management, enabling efficient route planning and real-time tracking of shipments.

3 . AI in Education:

Education is another domain where AI is making a significant impact. Adaptive learning platforms leverage AI algorithms to personalize education and cater to individual student needs. AI-powered virtual tutors and chatbots provide instant assistance and support, fostering a more engaging and interactive learning experience. Additionally, AI tools are being utilized for automated grading and assessment, saving educators valuable time.

4 . AI in Agriculture:

AI is revolutionizing agriculture by improving productivity and sustainability. Unique applications include drone technology equipped with AI algorithms to monitor crop health and optimize irrigation. AI-powered analytics assist farmers in making data-driven decisions regarding planting, fertilization, and pest control. This results in increased crop yields, reduced resource wastage, and a more sustainable approach to farming.

5. AI in Finance:

The financial industry is leveraging AI for unique applications such as fraud detection, risk assessment, and algorithmic trading. AI-powered chatbots and virtual assistants are providing personalized financial advice and enhancing customer service. Additionally, AI algorithms are analyzing vast amounts of financial data, enabling more accurate predictions and investment recommendations.

6 AI in Creative Industries:

AI is making waves in the creative realm, offering unique applications that augment human creativity. AI-generated art, music, and literature are challenging traditional notions of artistic creation. AI algorithms can analyze vast amounts of data, patterns, and styles to produce unique and novel compositions, enabling artists to explore new frontiers and push boundaries.

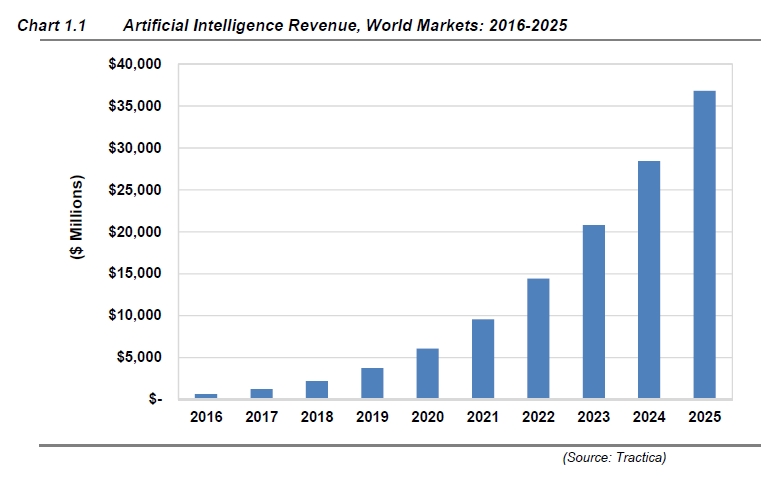

The Rise of AI-Centric Investment Products:

Artificial intelligence Stock : In response to the AI boom, financial institutions and fund sponsors have rushed to meet the growing demand for AI-centric investment opportunities. The launch of AI-focused exchange-traded funds (ETFs) and mutual funds allows investors to gain exposure to companies leading the AI revolution. These investment products assemble a diversified portfolio of stocks, emphasizing companies at the forefront of AI research, development, and implementation.

Opportunities and Challenges:

Artificial intelligence Stock :The proliferation of AI-focused investment products presents both opportunities and challenges. On the one hand, investors can benefit from the potential growth and profitability of companies driving the AI boom.in Artificial intelligence Stock These investments offer exposure to innovative technologies and disruptive advancements that have the potential to reshape industries. However, challenges arise in identifying the most promising companies amidst a rapidly evolving AI landscape, as well as managing risks associated with the volatility and uncertainties inherent in emerging technologies.

Ethical Considerations and Regulation:

As AI continues to permeate various aspects of society, ethical considerations and regulatory frameworks become paramount. Responsible AI development must prioritize privacy, security, and fairness, ensuring that AI algorithms and systems are transparent and unbiased. Regulators are grappling with the need to strike a balance between fostering AI innovation and safeguarding against potential risks, including algorithmic biases and unintended consequences.

Future Prospects and Impacts:

The Artificial intelligence Stock boom is poised to have a profound and enduring impact on financial markets. The integration of AI technologies across industries will drive efficiencies, disrupt traditional business models, and create new opportunities. Sectors such as healthcare, transportation, finance, and manufacturing will experience significant transformations as AI becomes increasingly pervasive. Investors, companies, and policymakers must closely monitor and adapt to the evolving AI landscape to capitalize on its potential while addressing the challenges it presents.

What do investors have to know about AI to navigate the changing market to landscape?

Artificial intelligence (AI) is often hailed as a disruptor, a term used to describe innovations that bring about significant changes in our lives. However, disruptors have been shaping human history since time immemorial. Take the invention of the wheel, for example, which revolutionized transportation and transformed societies. Similarly, the printing press was a groundbreaking disruptor that democratized knowledge and sparked a revolution in communication. These historical disruptors paved the way for progress and reshaped entire civilizations. In this context, AI's disruptive potential is a continuation of the transformative forces that have propelled human evolution, promising to revolutionize industries, redefine work processes, and enhance our understanding of the world.

Danger ahead of Investing in “Disruptive” New Technology

In the fast-paced world of investing, the allure of "disruptive" new technologies can be enticing. However, history has repeatedly shown that caution is warranted when considering investments in these groundbreaking innovations. This unique note highlights the lessons learned from renowned investor Warren Buffett and serves as a reminder to approach such opportunities with a discerning eye. Buffett's insights on the auto and airline industries offer valuable perspectives. Despite the undeniable impact of automobiles and airplanes on society, investing in these industries proved challenging. Thousands of auto companies dwindled down to a mere three survivors, while the aggregate returns from stock investments in the airline industry remained dismally low. Buffett's baseball analogy further emphasizes the need for prudence in investment decisions. While batters must swing at good pitches to avoid striking out, investors have the luxury of patience and selectivity. Jumping into investments solely due to fear of missing out (FOMO) can lead to overvalued or overhyped opportunities that may not align with long-term financial goals. Applying these lessons to the current landscape, it's important to exercise caution when considering investments in disruptive new technologies like artificial intelligence (AI). While AI undoubtedly holds transformative potential, the soaring valuations of many AI companies raise concerns. It's crucial to evaluate the fundamentals, growth prospects, and valuations of these firms to determine if they align with individual investment strategies. Rather than succumbing to FOMO-driven hype, investors should focus on prudent decision-making. This means thoroughly researching potential investments, analyzing risk-reward ratios, and considering their own risk tolerance and time horizon. While disruptive technologies can create significant opportunities, it is essential to be mindful of potential pitfalls and avoid succumbing to the allure of investing solely based on the "next big thing." In conclusion, the warning to beware of investing in "disruptive" new technologies echoes the wise advice of Warren Buffett. By approaching such investments with caution, thoroughly evaluating opportunities, and adhering to individual investment strategies, investors can navigate the ever-evolving landscape of innovation while mitigating risks and maximizing long-term potential.

Warren Buffett on AI ?

Artificial intelligence Stock : Warren Buffett, renowned investor and CEO of Berkshire Hathaway, has highlighted the historical challenges investors face when it comes to disruptive innovations. Drawing parallels to the auto industry and the airline industry, Buffett noted how these transformative inventions had enormous impacts on society but often led to disappointing outcomes for investors. Despite the significant influence of automobiles and airplanes, only a few surviving companies proved profitable in the long run. This history serves as a reminder that investing in innovation does not guarantee success. Buffett often employs a baseball analogy to explain investing, emphasizing the importance of waiting for the right opportunities. While batters must swing at good pitches to avoid being called out on strikes, investors have the luxury of watching numerous opportunities go by without feeling pressured to engage. When it comes to investing in artificial intelligence (AI), Buffett suggests that many investors may be driven by the fear of missing out (FOMO) rather than considering the actual investment potential. He cautions that while AI is a significant disruptor, it may not be in the optimal investment zone for most retirement investors, especially considering the high valuations associated with many AI companies. In summary, history has shown that even groundbreaking innovations can pose challenges for investors. Buffett's advice encourages investors to be patient and selective, focusing on opportunities that align with their investment strategies and risk profiles, rather than succumbing to the FOMO-driven hype surrounding AI.

Artificial intelligence Stock Artificial intelligence Stock Artificial intelligence Stock Artificial intelligence Stock Artificial intelligence Stock Artificial intelligence Stock Artificial intelligence Stock Artificial intelligence Stock Artificial intelligence Stock

Conclusion :

The AI boom's influence on financial markets is undeniable, with AI-focused firms like Nvidia reaching historic market capitalization milestones. The rise of AI-centric investment products reflects the growing interest in capitalizing on the AI revolution. However, careful consideration of ethical and regulatory aspects is crucial to ensure responsible development and deployment of AI technologies. As the AI landscape continues to evolve, investors and market participants must stay informed and adapt to the ever-changing dynamics to seize opportunities and navigate the challenges presented by this transformative phenomenon.

Our social media link :https://www.facebook.com/profile.php?id=100091399643379 our Home page :https://micronewss.com/